Gapping Rotation in SPY and News Based Rallies Are A Warning

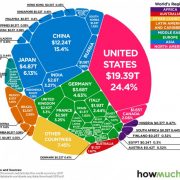

As holiday trading sets up in the global markets, the SPY is starting to show signs of volatility and warning of a potential top by gapping as price attempts to trade sideways. This type of top formation, along with the fact that the overnight REPO facility continues to roil the markets, continues to draw our researchers to the conclusion that some type of debt or liquidity issue is just below the surface of the global markets.

We believe the topping formation in the SPY may be a sign that the holiday trading, normally spanning from just before Thanksgiving to sometime after January 10th or 15th, may prompt a very volatile price rotation in the global markets. The lack of liquidity in the market at this time often leads to fairly narrow ranges in price. Yet we are seeing volatility continue to stay somewhat high at this time and the REPO issue hangs over the heads of nearly every investor at this time.

One of our friends, an ex-Chicago floor trader, wrote to us just a few days ago suggesting he was receiving phone calls from many friends and associates in the US and overseas about the REPO issue. We believe this issue is now taking root as a concern for global investors and could become a major issue for the markets going forward into 2020. Our friend’s suggestion was to “buy gold and to pair back equity positions”.

This SPY Daily chart highlights the GAPS in price that has our research team concerned. A breakdown below $308 would qualify as a new Bearish Price Trend. If the most recent gap is filled to the downside, the price may begin to accelerate lower, confirming our analysis.

On the flip side of that scenario, is a breakout above $315 that can hold for a couple of days or into the end of the week. That would trigger a new uptrend and possibly a Santa Rally.

This Weekly YM chart highlights the Hangman pattern set up last week with a very long lower wick. This pattern set up at the price high is very indicative of a topping formation. The fact that it set up just below the GREEN Bullish Price Trigger level near $28,175 suggests this level is acting as resistance. A breakdown in price near this level could prompt a move to levels below 26,000.

Traders need to stay cautious over the next 5+ weeks as the lack of volatility in the market may prompt some very big price moves. We believe the REPO issue may have some legs in the future and we believe a rotation may begin before Christmas 2019.

If liquidity continues to diminish, a flash crash type of event would not be uncommon. We believe there are serious risks of a downward price rotation in the works and urge our followers and members to prepare for unknown risks over the next 5+ weeks.

Normal trading volume will not likely start to pick back up till after January 15th. We have at least 4+ weeks of unknowns to contend with in a very illiquid market. We are going to trade with the short term market trends and be agile going into the new year.

S&P 500 & BOND TREND – DECEMBER 13

The stock market was setting up a topping pattern the past couple weeks but that has now been negated. The charts/technicals are bullish and so are we it’s that simple really.

Yesterday more chatter of tariffs and other news sparked a strong equities rally at the open bell which sent stocks sharply higher while bonds corrected. With yesterday’s S&P 500 hitting new highs after a fear-based correction two weeks ago the market is now back in rally mode and should have enough energy to sustain a rally into the year-end.

While we trade based on technical analysis, there will be days when news hitting the market and causes some large moves on the same day we have technical buy or sell signals. Like yesterday, for example, The past couple of trading sessions we have been talking about how the S&P 500 has to hie new highs to kick things back into a new uptrend after the previous week’s price correction. Yesterday, the SP500 broke to new highs, while bonds broke down triggering a new breakout rally in stocks. Sure there was news to help push price higher but none the less all our analysis has confirmed for the buy trigger.

We touch on other markets or news from time to time but we do not take any of the news into consideration for our trades. While there are many warning signs out there pointing to dark times ahead for the financial markets like the Repo market and many others, the reality is we follow the price, not the news. The market is climbing a wall of worry among educated traders and investors, and that’s what the market does best and we can’t fight it. Eventually, the price will turn down for a mega bear market and we will be there to profit from it, until then we ride the fearful rally higher.

Chris Vermeulen

www.TheTechnicalTraders.com